Trading commodity futures and options involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

By: Larry Baer, senior broker at Zaner Group.

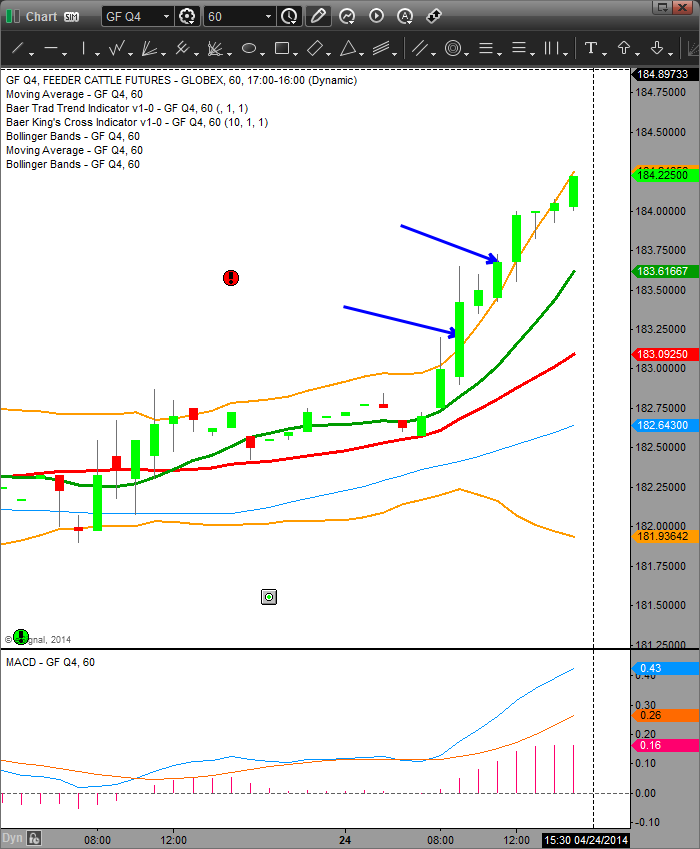

Feeder Cattle: August feeder cattle futures are showing a buy signal today on the daily chart.

Subscribe FREE to Larry Baer’s Daily Charts & Set-Ups Newsletter.

For additional customizable charts and quotes visit Markethead.com for a FREE, no-obligation 30 day subscription.

Call me for trade set-ups at (312) 277-0112

SEE CHART

Call me for details and trade set-ups at (312) 277-0112

or toll free at 888-281-4161

or email: Lbaer@Zaner.com

How to open an account with Zaner Group.

Open an account with Larry Baer at Zaner Group.

Subscribe FREE to Zaner Group’s Daily Research Newsletter.

View my thoughs on other markets at Larry Baer’s Options & Futures Trading Strategies.

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. All known news and events have already been factored into the price of the underlying commodities discussed.

- Judy Crawford’s Meat futures Market Update (5/16)

- Rick Alexander’s Meat futures commentary (5/16)

- Rick Alexander’s Meat futures commentary (5/15)

- Live Cattle & Feeder Cattle futures give buy signals (5/15)

- Judy Crawford’s Meat futures Market Update (5/11)

- Rick Alexander’s Energy futures commentary (5/16)

- Metal complex tumbles, Gold futures generate a sell signal (5/11)

- Judy Crawford’s Metal futures Market Update (5/16)

- Rick Alexander’s Currency futures commentary (5/16)

- Heating Oil & Gasoline RBOB show sell signals (5/14)

- Judy Crawford’s Grain futures Market Update (5/16)

- Cotton #2 futures show a fresh sell signal (5/16)

- Rick Alexander’s Stock Index futures commentary (5/16)

- Corn Catches a Nice Bounce Off of Lows (5/17)

- Judy Crawford’s Crude Oil futures Market Update (5/16)

- Rick Alexander’s Softs futures commentary (5/16)

- Markethead: Quotes, charts, news, commentary and more.

Rick Alexander’s Meat futures commentary (5/18)

Trading commodity futures and options involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge and financial resources.

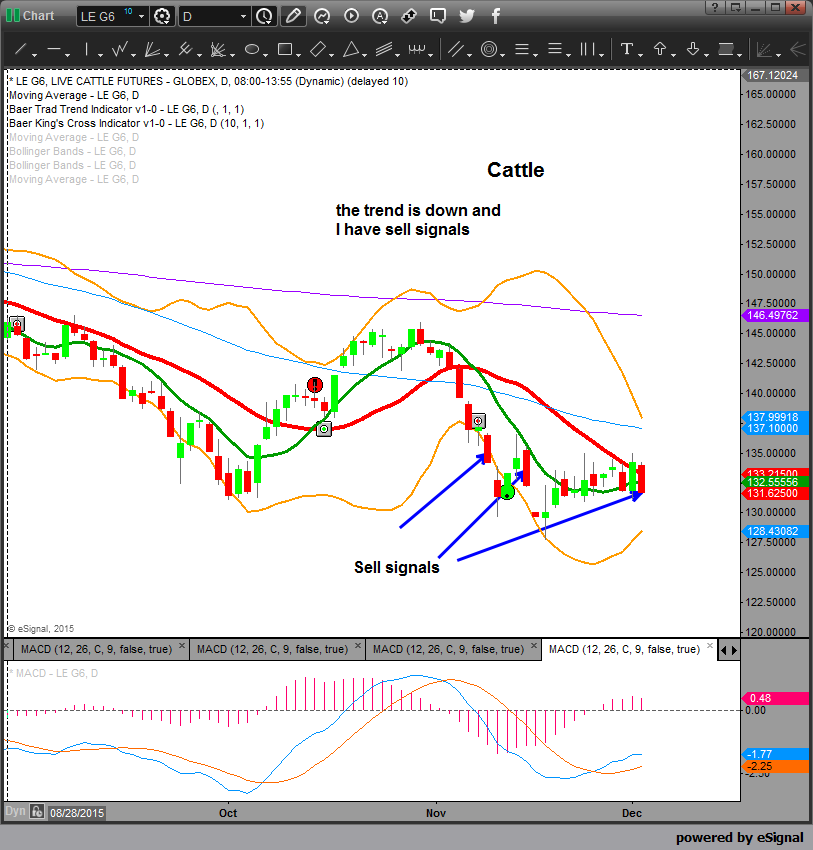

By: Rick Alexander, senior broker at Zaner Group.

MEATS: 5/18/12 CATTLE ON FEED. Higher closes yesterday for lean hogs, live cattle and feeder cattle futures. The June cattle contract settled higher for its forth session in a row making its best high and close since late March giving me a BUY SIGNAL. Closing over 1150 basis the June contract was critical in my opinion. The August feeder cattle also gave me a BUY SIGNAL after its best high and close since the middle of March and filling a gap earlier in the week. Also, the feeders are still now above some in a decent looking support areas. Next closing over 160 is important to continue much higher in my opinion. Hogs settled higher making their best high and close in 2 1/2 weeks since late April also still having a gap at 9022 while looking lower overall. However, they also look like they could be forming a potential bottom. For additional customizable charts and quotes visit Markethead.com for a FREE, no-obligation 30 day subscription. BUY SIGNALS FOR LIVE CATTLE AND FEEDER CATTLE FUTURES. SELL SIGNAL FOR LEAN HOGS. CALL FOR DETAILS AT (312) 277-0107 OR EMAIL ralexander@zaner.com!

Rick Alexander

(312) 277-0107

ralexander@zaner.com

Zaner Group

Subscribe FREE to Zaner Group’s Daily Research Newsletter.

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. All known news and events have already been factored into the price of the underlying commodities discussed.